Milestones and News

- 2025

- 2024

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2014

- 2013

- 2012

- 2011

- 2010

- 2009

- 2008

2025

TR Capital completes full exit from Source Photonics

TR Capital is pleased to announce that it has fully exited its stake in Source Photonics in September 2025 through a trade sale.

Founded in 2000, Source Photonics designs and manufactures optical transceivers and components used in datacenter and broadband markets. Its key customers include Huawei, Amazon, Microsoft, and Google etc. Key applications served include datacenter, routing, wireless, and fiber-to-premise (FTTx). The company has a presence in China (Chengdu and Jintan), Taiwan (Taipei) and the United States (West Hills, California).

TR Capital completes a preferred equity investment in Monk’s Hill Fund I portfolio, secured against Ninja Van, KKday and ELSA

TR Capital is pleased to announce the completion of a preferred equity investment in Monk’s Hill Fund I, secured against its three largest portfolio companies – Ninja Van, KKday, and ELSA.

The key position, Ninja Van, is a technology-driven e-commerce logistics provider specializing in last-mile delivery services across Southeast Asia.

KKday is a Taiwan-based travel e-commerce platform, covering over 300k travel experiences across more than 90 countries and regions.

ELSA is an innovative mobile application designed to enhance English speaking skills through artificial intelligence, with core markets including Southeast Asia, Japan, the US, and Latin America.

TR Capital completes acquisition of 3 companies, MoEngage, Shadowfax and Whatfix from Eight Roads

TR Capital is pleased to announce a new secondary transaction worth over USD 50 million, acquiring stakes in MoEngage, Shadowfax and Whatfix from Eight Roads Ventures.

MoEngage is a leading customer engagement platform trusted by over 1,200 global brands.

Shadowfax is one of India's fastest-growing last-mile logistics companies, operating in over 2,500 cities.

Whatfix is a global leader in digital adoption solutions for enterprises worldwide.

India has been a core focus market for TR Capital since 2008. The country remains one of the most attractive secondary private equity markets in Asia.

This deal underscores TR Capital's ability to unlock value through complex portfolio transactions, with short turnaround times. This transaction, from initial conversations to closing took only three months.

The firm will continue partnering with innovative businesses that shape India's digital economy.

TR Capital completes full exit from WeRide

TR Capital is pleased to announce that it has fully exited its stake in WeRide in April 2025.

WeRide (NASDAQ: WRD) is a global leader in large-scale commercial deployment of autonomous driving, with a presence in over 30 cities across 10 countries. The company offers a portfolio of five core products, including Robotaxi. WeRide is listed on NASDAQ since October 2024 and has been recognized in the 2024 Fortune Future 50 List.

TR Capital completes full exit from NetEase Cloud Music

TR Capital is pleased to announce that it has fully sold its stake in NetEase Cloud Music.in April 2025.

NetEase Cloud Music (HKEX: 9899) is one of the leading online music platforms in China, featuring an interactive content community for music enthusiasts in terms of user scale and engagement.

TR Capital substantially exits investment in RoboSense

TR Capital is pleased to announce that it has substantially divested close to 90% of its stake in RoboSense.

RoboSense (HKEX: 2498) is an AI-driven robotics technology company that supplies industry-leading components and solutions for the robotics market. The company was listed on the Hong Kong Stock Exchange in January 2024.

TR Capital completes full exit from Full Truck Alliance

TR Capital is pleased to announce that it has fully sold its stake in Full Truck Alliance.

The Full Truck Alliance (NYSE: YMM) platform is a leading digital freight platform in China, connecting shippers with truckers to facilitate shipments across distance ranges, cargo weights and types.

TR Capital wins PEI Secondaries Firm of the Year in Asia for the 7th time

TR Capital is honored to be the recipient of Secondaries Firm of the Year in Asia from the leading industry publication Private Equity International (PEI). It is the seventh time in the last nine years that TR Capital has earned this distinction, a testament to our leadership in the region.

Please refer to Private Equity International’s official announcement for more details:

TR Capital announces the joining of new Head of Investor Relations and Chief Operating Officer

TR Capital is pleased to announce that Jean Daniel ("JD") Lorenzo has joined the firm as Managing Director, Head of Investor Relations, and Chief Operating Officer, based in the firm's Singapore.

With over two decades of leadership and managerial expertise in investment banking, wealth and asset management at several multinational financial institutions, JD's contribution will be critical in enhancing TR Capital's fundraising and operations capabilities. Previously, JD was the Chief Risk Officer of Loomis Sayles Capital Re, an insurance risk transfer startup, overseeing the design and setup of the risk infrastructure. Prior to this, he was a member of the Management Committee of BNP Paribas Wealth Management APAC, in charge of the bank’s credit activity. Prior to this, JD was a Managing Director in the Strategic Equity group of BNP Paribas, heading the emerging markets group.

2024

TR Capital announces the joining of new Managing Director Investment, Head of Business Development

TR Capital is pleased to announce that Yann Malka has joined the firm as Managing Director, Investment, and Head of Business Development, based in the firm's Singapore.

With more than a decade of experience in investment and business development across Asia, Yann's role will be pivotal in enhancing TR Capital's pan-Asian secondary capabilities. Previously, Yann was a director at iDi EM Partners, overseeing investments at the firm across China, India, Southeast Asia, Africa-MENA, and Latin America. During his tenure, he led key initiatives, notably heading the firm’s Hong Kong office for four years, focusing on investment execution, business development, and portfolio management.

TR Capital granted with an MAS license in Singapore

TR Capital has been granted a Capital Markets Services License with the Monetary Authority of Singapore.

Please refer to the official website of the Monetary Authority of Singapore for further details.

TR Capital announces appointment of fourth partner in drive for accelerated growth

TR Capital is pleased to announce that Deepanshu Madan has been made the firm’s fourth Partner, marking an important milestone in the firm’s strategic growth.

Deepanshu joined TR Capital seven years ago as a Director, and has since played a pivotal role in the development of the firm’s retail and healthcare portfolio across Asia. In November 2023, he was appointed as the Chief Executive Officer of one of the firm’s portfolio companies, Pharmacity, in Vietnam. At Pharmacity, he is implementing a thorough redesign of the business model to return it to sustainable profitability.

TR Capital completes full exit from Sedemac

TR Capital is pleased to announce that it has fully divested its stake in Sedemac to A91 Partners and 360 One via a secondary trade completed in May 2024.

Incubated at Indian Institute of Technology-Bombay (IIT-B) in 2007, Sedemac is a leading manufacturer of innovative powertrain controls technology and auto part components. Sedemac focuses on controls for small powertrains, both for on-road and off-road markets where its solutions are deployed in two-wheeler vehicles and generators. Following this transaction, TR Capital will step down from the board of Sedemac.

TR Capital completes further partial exit from Lenskart

TR Capital is pleased to announce that it has further divested part of its stake in Lenskart Solutions Private Limited (“Lenskart”) to Temasek via a secondary trade completed in May 2024.

Founded in 2010, Lenskart is Asia’s largest omni-channel retailer and manufacturer of premium quality and stylisheyewear. Lenskart is revolutionizing the eyewear industry by offering a seamless truly omni-channel customer experience spanning across online, mobile application and 2,400+ stores (as of March 2024) across India and globally. Lenskart integrates technology into all aspects of its operations to enhance customers’ browsing, shopping and purchasing experience, in addition to manufacturing and supply chain optimization. Following this transaction, TR Capital still retains an observer seat on Lenskart’s board.

TR Capital completes secondary direct investment in Fibe

TR Capital is pleased to announce that it led the secondary direct investment in Fibe, a leading consumer lending company in India.

Established in 2015, Fibe has built a one stop financial ecosystem for aspirational middle-income segment. Fibe has a host of digital financial products offering, including personal loans, checkout finance offerings, and co-branded credit cards.

TR Capital wins two Private Equity International awards for 2023

TR Capital is honoured to be the recipient of two awards from leading industry publication Private Equity International (PEI) in the Secondaries category.

For the sixth time in eight years, TR Capital has been recognized as PEI’s Secondaries Firm of the Year in Asia, reflecting the company’s strong track record, continuous innovation and depth of expertise across APAC. The firm also won PEI’s Secondaries Deal of the Year in Asia for the second time, recognizing its milestone portfolio solution transaction in India with Samara Capital, which is the first transaction in TR Capital’s fifth flagship fund and a sign of the company’s growing presence in India. In late 2023, TR opened an office in New Delhi to complement its existing office in Mumbai and four other offices across Asia, namely Hong Kong, Singapore, Shanghai and Shenzhen.

These awards are particularly significant as they are based on voting by PEI’s readership, representing investors, peers and other leading influencers in global private equity. Since it was founded in 2007, TR Capital has become known as a pioneer for secondary investing in innovative and high-quality companies in APAC, and the leading player in the region for active direct secondary investments and portfolio solutions.

Please refer to Private Equity International’s official announcement for more details: https://www.privateequityinternational.com/pei-awards-2023-secondaries-winners/

2023

TR Capital completes secondary direct investment in Rokae

TR Capital is pleased to announce that it has completed a secondary direct investment in Rokae.

Established in 2015, Rokae is a leading Chinese industrial robot manufacturer which offers lightweight, heavyweight and collaborative robots.

TR Capital completes secondary direct investment in GaiaWorks

TR Capital is pleased to announce that it has completed a secondary direct investment in GaiaWorks.

Established in 2009, GaiaWorks is the leading Chinese service provider of digitalized workforce management solutions to clients in labor-intensive industries such as retail and manufacturing. GaiaWorks assists its clients with effectively controlling labor costs, enhancing workforce efficiency, reducing compliance risks, and improving employee engagement.

TR Capital completes further partial exit from Lenskart

TR Capital is pleased to announce that it has further divested part of its stake in Lenskart Solutions Private Limited (“Lenskart”) to Abu Dhabi Investment Authority (ADIA).

Founded in 2010, Lenskart is today the largest eyewear service provider in India and also has operations in Southeast Asia and the Middle East. It serves over 11 million customers annually through its omni-channel shopping experience, which includes both online and over 1,800 physical stores. Lenskart integrates technology into all aspects of its operations to enhance customers’ browsing, shopping and purchasing experience, in addition to manufacturing and supply chain optimization. Among Lenskart’s digital offerings is a virtual 3D try-on tool; AI-powered facial mapping and frame recommendation features; smart physical stores with seamless omni-channel experience; footfall tracking beacons, heat maps and demographic analytics; and intelligent supply-chain and inventory-management solutions.

TR Capital wins the “Secondaries Firm of the Year in Asia” Award (2022) by Private Equity International

TR Capital is delighted to announce that it has won the "Secondaries Firm of the Year in Asia" award in Private Equity International’s 2022 Awards. Please refer to the official announcement on Private Equity International's website.

The annual PEI Awards recognize the private equity industry's standout firms. TR Capital is honoured to have been consistently recognized by investors and peers for its leadership in Asian Secondaries, and we are proud to have won this award for the fifth time over the past seven years – 2016, 2017, 2019, 2021 and 2022.

Please see below an excerpt from Private Equity International which details the award.

TR Capital leads $150 million fund restructuring in Samara Capital’s portfolio

TR Capital is pleased to announce that it has completed an investment in a multi-asset continuation fund to acquire a portfolio of three Indian companies from Samara Capital Fund II.

The transaction raised $150 million to acquire interests in SMT (Sahajanand Medical Technologies), India’s largest manufacturer of minimally invasive cardiovascular devices and supplier of stents; FirstMeridian Business Services, India’s third largest staffing company with a headcount of more than 118,000 associates; and Paradise Food Court, a biryani restaurant chain with 80 outlets across 10 cities.

2022

TR Capital Positions Firm to Capture Tremendous Growth Opportunity in Southeast Asia with New Singapore Office

TR Capital named one of the “Top 10 China Active Investment Firms in Secondaries” in Zero2IPO’s 2022 China Venture Capital & Private Equity Annual Ranking

TR Capital has been named one of the “Top 10 China Active Investment Firms in Secondaries” in Zero2IPO’s 2022 China Venture Capital & Private Equity Annual Ranking. Zero2IPO Rankings are highly competitive and recognize the most active and influential investors in the private equity market in China. TR Capital is honored to be recognized by investors and peers as a leader in the secondary investments space in China.

TR Capital Partially Exits BigBasket

TR Capital, the leading Asian secondary private equity firm, today announced that it has divested 50% of its investment in Supermarket Grocery Supplies Pvt. Ltd. (“BigBasket”) to the Tata Group.

Founded in 2011, BigBasket is the largest online food and grocery store in India. With a footprint across 25+ Indian cities, BigBasket carries over 18,000 products and over 1,000 brands in its catalogue. Since inception, In addition to its core online grocery delivery business, BigBasket also operates through BBDaily, which offers subscription to daily milk and fresh products, and BBInstant, which offers fast moving products through vending machines.

TR Capital wins the “Secondaries Firm of the Year in Asia” Award (2021) by Private Equity International

|

|

TR Capital is delighted to announce that it was named "Secondaries Firm of the Year in Asia" in Private Equity International’s 2021 Awards. The annual PEI Awards recognize the private equity industry's standout firms. Having also won the Firm of the Year Award in 2019, 2017 and 2016, TR Capital is honored to have been consistently recognized by investors and peers for its leadership in Asian Secondaries.

With the ever-increasing demand for liquidity in Asia

private equity, TR Capital continues to see compelling opportunities to invest

in leading innovative companies by offering tailored liquidity solutions to

existing shareholders. "PEI Awards 2021: Secondaries winners" (16 March 2022) (subscription required) |

2021

TR Capital Fourth Flagship Fund significantly oversubscribed and closes at its Hard Cap of US$350m

TR Capital wins the “Secondaries Deal of the Year in Asia” Award (2020) by Private Equity International

|

TR Capital is delighted to announce that it has won the "Secondaries Deal of the Year in Asia" in Private Equity International’s 2020 Awards. The annual PEI Awards are awarded to the best-in-class institutions operating in the Private Equity industry. TR Capital is honored to have been recognized by investors and peers for its innovative RMB-to-USD Fund Restructuring of Kinzon Capital’s RMB fund. "PEI Awards 2020: Secondaries winners" (5 March 2021) (subscription required) |

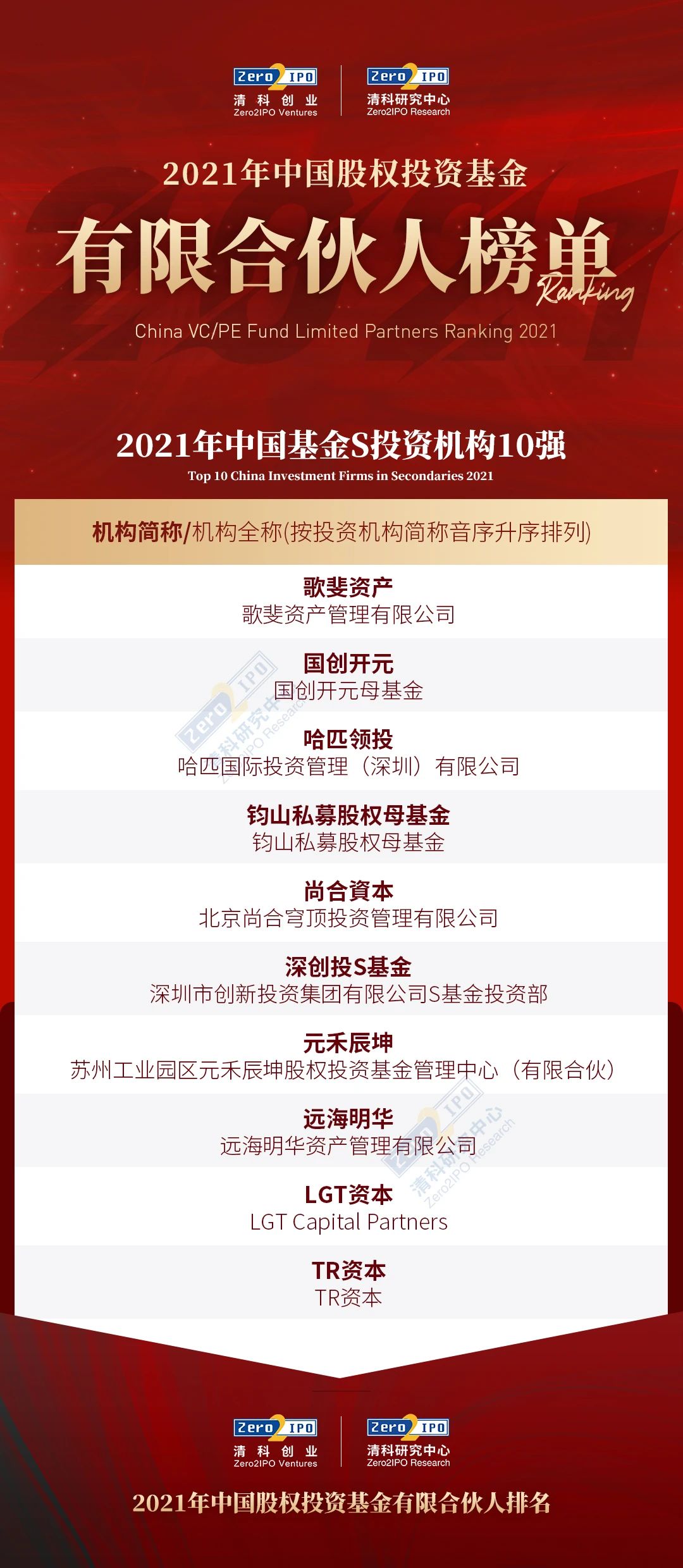

TR Capital named one of the “Top 10 China Investment Firms in Secondaries” in Zero2IPO’s 2021 China VC/PE Fund Investors Ranking

TR Capital

has been named one of the "Top 10 China Investment Firms in

Secondaries" by Zero2IPO in its 2021 China VC/PE Fund Limited Partners

Ranking 2021. The annual Zero2IPO Rankings recognize the most active and

influential investors in the private equity market in China. TR Capital is

honored to have been recognized by investors and peers as a leader in secondary

investments in China.

TR co-leads innovative secondary transaction to buy a portfolio of six Chinese Healthcare companies using its QFLP

TR Capital, the leading Asian secondary private equity firm, is pleased to announce today that it has co-led a transaction which saw Huagai Capital restructure its high-quality healthcare investments into a RMB800 million continuation fund.

The transaction, which TR Capital co-led with Shenzhen Capital Group, saw Huagai Capital, a China-focused private equity firm, restructure six high quality investments in the Healthcare sector from three of its existing funds into a new RMB-denominated continuation fund.

“TR Capital’s role as co-lead in this restructuring transaction is an exciting milestone for our firm. We forecast strong demand for this new innovative structure in China, and see this as a better way to invest in fast-growing and innovative companies in the Digital Consumer, Technology and Healthcare sectors”, commented Frederic Azemard, Managing Partner of TR Capital.

“The Healthcare sector is a key focus area for TR Capital in China given its growth and innovation. We see an increasing number of leaders emerging amongst biopharmaceutical, medical devices and in particular oncology companies. We use an active secondary approach to invest in these companies,” continued Mr. Azemard.

TR Capital Leads Consortium to Invest US$95.7 million in Bochewang, the Number One Online Auction Platform for Salvage Cars in China

TR Capital, the leading Asian secondary private equity firm, is pleased to announce that it has led a consortium of investors which has made a US$95.7m secondary direct investment in Bochewang as part of the company’s VIE restructuring process.

Established in 2014, Bochewang is today the largest online auction platform for salvage cars in China, on which over 75,000 transactions are completed annually. The company provides a venue for sellers (primarily insurance companies) to efficiently dispose of vehicles to a nationwide buyer pool which includes repair shops, vehicle dismantlers and auto parts dealers.

As the lead investor, TR Capital invested over US$45m in the transaction. Upon completion of the transaction, TR Capital will look to support Bochewang in continuing to scale its operations and enhancing the range of services offered to its customers as an active investor and member of the board of directors.

Frederic Azemard, Managing Partner of TR Capital, commented on the transaction, “We are pleased to have led this consortium to invest in Bochewang. At TR Capital we invest in strong management teams, leading new economy companies, and Bochewang is an excellent example of this. We are looking forward to working with Jianpeng Chen and his team to together maximise the company’s potential.”

TR Capital Becomes First Secondary Private Equity Firm to Open a Shenzhen Office

TR Capital, the leading Asian secondary private equity firm, today announced the opening of its fourth office in Shenzhen. The firm, headquartered in Hong Kong, is also present in Shanghai and Mumbai.

Paul Robine, Founder and CEO of TR Capital, commented on the opening, “We are thrilled to be the first secondary private equity firm to open an office in Shenzhen. This is one of the most innovative cities in the world and it is home to a large and increasing number of high calibre companies. Shenzhen’s rapid growth, dynamic population, and maturing private equity ecosystem, make this an area of immense interest and one which matches well with TR Capital’s investing expertise. We believe the combination of Hong Kong, as an international financial center, and Shenzhen, as an innovation hub, will create great value for the firm and its investors.

”Shenzhen is the third largest PE market in China with AUM of RMB2,072 billion (US$319 billion) as of February 2021 according to the Asset Management Association of China. The PRC government is implementing measures to encourage further venture capital and PE investment in the Greater Bay Area, which will continue to propel the demand for liquidity solutions in the space.

“With the launch of our new office in Shenzhen, TR Capital is sending a clear message to investors - we will continue to be at the forefront of investing in China and in the technology and innovation space,” continued Paul Robine. “To date we have made eight investments in Shenzhen and the Greater Bay Area including the leading LiDAR systems provider RoboSense, smart mobility company WeRide, and 3D sensing chips developer and manufacturer Adaps Photonics,” Mr. Robine added.

TR Capital Partially Exits Lenskart

TR Capital Completes Secondary Direct Investment in Sapphire Foods

TR Capital, the leading Asian secondary private equity firm, today announced that it has completed a secondary direct investment in Sapphire Foods India Limited (“Sapphire Foods”).

Sapphire Foods is an omnichannel restaurant operator and the largest franchisee of YUM! Brands in the Indian sub-continent by revenue in the financial year 2020. It currently operates over 430 KFC, Pizza Hut and Taco Bell restaurants, mainly in India.

2020

TR Capital makes a Secondary Direct investment in Pharmacity

Founded in 2012, Pharmacity is Vietnam’s largest organized retail pharmacy chain, with more than 300 stores across Vietnam. Benefiting from the consumption upgrade trend in Vietnam, Pharmacity is in a leading position to consolidate the retail pharmacy sector and it has been ramping up its operations rapidly, with a revenue CAGR of 140% over the past two years. Pharmacity offers retail consumers prescription & OTC medicines, FMCG products and vitamins & supplements.

TR Capital’s Investment in Kinzon Capital featured on Secondaries Investor and FoF Weekly (母基金周刊)

TR Capital’s recently completed RMB-to-USD Fund Restructuring was the subject of articles from Secondaries Investor and FoF Weekly (母基金周刊).

“TR Capital backs yuan restructuring on China’s Kinzon – exclusive” (13 February 2020) (subscription required)

“疫情期间出现约一亿美元的S基金交易” (17 February 2020)

TR Capital wins the “Secondaries Firm of the Year in Asia” Award (2019) by Private Equity International

|

TR Capital has been named the "Secondaries Firm of the Year in Asia" in the Private Equity International 2019 Awards. The annual PEI Awards recognize the best-in-class institutions operating in the Private Equity industry. Having received this award in 3 of the past 4 years, TR Capital is honored to have once again been recognized by investors and peers as the leader in secondary investments in the Asia-Pacific region. "PEI Awards 2019: Secondaries winners" (2 March 2020) (subscription required) |

Colin Sau Hosted ChineseVenture (融资中国) Webinar on RMB-to-USD Fund Restructurings

TR Capital partner Colin Sau discussed the firm’s recently completed Kinzon Capital RMB-to-USD Fund Restructuring in a webinar sponsored by ChineseVenture (融资中国) magazine on 12/3/2020, which was attended by over 100 Chinese PE/VC industry professionals. Mr Sau shared TR Capital’s insights on RMB-to-USD Fund Restructurings as a pioneer of such transactions.

“重磅!中国首单!TR Capital人民币转美元基金交易经验分享” (7 March 2020)

Successful exit of Junshi Biosciences by TR Capital III, L.P.

TR Capital is pleased to announce that it has fully exited its direct investment in Shanghai Junshi Biosciences Co., Ltd. through on-market transactions on the Hong Kong Stock Exchange.

Established in 2012, Junshi Biosciences (HKEX: 1877) is an innovation-driven biopharmaceutical company that focuses on the discovery and development of innovative drugs and their clinical research and commercialization on a global scale.

TR Capital Completes Secondary Investment in Genesis Capital I L.P.

TR Capital is pleased to announce that it has completed a secondary investment in Genesis Capital I L.P.

Genesis Capital I L.P. is a 2015 vintage private equity fund focusing on China’s TMT sector. The fund is fully invested in high quality companies with strong growth potential and clear visibility on exits (including MissFresh, Full Truck Alliance, RED and Zhangmen).

Genesis Capital was founded by Richard Peng, who was previously Head of Investment and Corporate Vice President of Tencent.

The transaction marks the third investment made by TR Capital IV, L.P., TR Capital’s fourth flagship fund.

Successful exit of Guilin Seamild by TR Capital III, L.P.

TR Capital is pleased to announce that it has fully exited its investment in Guilin Seamild Foods Co Ltd through on-market transactions on the Shenzhen Stock Exchange.

Guilin Seamild (SZSE: 002956) is a leading Chinese manufacturer and distributor of premium oatmeal products and is the main competitor of Quaker in China. The company prides itself on quality oats that it sources directly from contract farmers in Western Australia. Its product categories include pure oatmeal, compound oatmeal and ready-to-eat (RTE) oatmeal. All of Seamild’s products are marketed under the “Western Oats” (“西麦”) brand.

Paul Robine discussed about the rise and evolution of Asia private equity secondaries in J.P. Morgan Asia Private Equity Conference 2020

TR Capital Founder and CEO Paul Robine discussed about the rise and evolution of Asia private equity secondaries over the past decade, and the growing opportunities that have arisen for private equity secondaries specialists such TR Capital in this challenging climate. Mr Robine also shared TR Capital’s insights on how the firm is investing heavily in big data, which will create the memory and institutional knowledge of the firm and source proprietary deals that are more interesting than traditional PE opportunities.

“J.P. Morgan Asia Private Equity Conference 2020” (22 September 2020)

TR Completes Secondary Direct Investments in Full Truck Alliance and Aibee

TR Capital is pleased to announce that it has completed secondary direct investments in Full Truck Alliance Co. Ltd. (“FTA”) and Aibee Inc. (“Aibee”). This is part of a broader portfolio of 3 assets purchased from a single seller, that TR Capital started to acquire in September 2020.

2019

TR Capital makes a Secondary Direct investment in Moviebook by acquiring partially the stake of a RMB fund looking for liquidity solutions

Founded in 2009, Beijing Moviebook Technology Co, Ltd ("Moviebook") is a leading visual technology company engaged in the business of native in-video advertising. Moviebook helps advertisers insert virtual branded products or signages into videos on a real-time basis or during the post-filming stage. Such objects are either compatible with the video surroundings so that they will not significantly disrupt viewers, or are relevant to the video scenes so that viewers are more motivated to interact with the advertisements.

TR Capital makes a Secondary Direct investment in NetEase Music

Founded in 2013, NetEase Music is an online music platform that targets younger people in middle to upper tier Chinese cities. It has successfully created a community for music lovers and independent musicians who are trend setters of the Chinese music industry. As a result, NetEase Music now has one of China’s most active music platforms, with a market-leading user retention rate as well as one of the largest catalogues of user-generated content. NetEase Music’s revenues are generated mainly from paying users, advertisements and merchandising.

TR Capital makes a Secondary Direct investment in BigBasket

Founded in 2011, BigBasket is now India’s largest online food and grocery retailer with a presence in 25 Indian cities and a 40% share of the Indian online grocery retail market. Since inception, BigBasket has scaled its business model and surpassed its competitors on scale through three key pillars: a fully integrated and end-to-end controlled supply chain, a superior customer experience and a robust technology backbone.

TR Capital acquired its stake in BigBasket from Zodius Capital.

TR Capital increases its stake in EVISU by buying out more existing shareholders

EVISU is a denim brand with 168 stores in China. TR entered the company in 2018 by providing liquidity to existing shareholders. Given the fast growth of the company, TR Capital recently increased its share in the company by acquiring the stakes of certain existing shareholders.

TR Capital Completes Kinzon Capital RMB to USD Fund Restructuring

TR Capital is pleased to announce that it has completed a RMB to USD fund restructuring of Kinzon Capital’s RMB Fund. The transaction involves the acquisition of a portfolio of nine Chinese companies held by Kinzon Capital’s RMB Fund by a newly formed USD-denominated vehicle.

The transaction size is USD 75 million and TR Capital is the lead investor. The portfolio of nine fast growing new economy and technology Chinese companies was acquired at a substantial discount to NAV. Given the strong exit visibility, TR Capital expects to recover its investment cost within 3 years and fully exit the investment within 5 years.

The Transaction marks the first investment made by TR Capital IV, L.P., TR Capital’s fourth flagship fund.

2018

For the second consecutive year, TR Capital wins the “Secondaries Firm of the Year in Asia” Award (2017) by Private Equity International

https://www.privateequityinternational.com/pei-awards-see-winners/

TR Capital invests in Arohan Financial Services via a Secondary Direct transaction by buying out 2 existing shareholders: Aavishkaar Group and TIPEF2

TR Capital increases its stake in Lenskart by partially buying out TPG and Unilazer's stake

TR Capital performs RMB portfolio restructuring into a USD vehicle with Loyal Valley Capital

TR Capital is pleased to announce the eighth investment of TR Capital III, L.P. with the secondary investment in Loyal Valley Capital Advantage Fund LP (“LVC”).

LVC is a private equity vehicle created in November 2017 to restructure RMB investments into a USD vehicle.

TR Capital is entering at an attractive discount to the Portfolio Companies’ Net Asset Value. In addition, TR Capital will hold one out of five Advisory Board seats in LVC Fund.

Successful exit of Flipkart by TR Capital II, L.P.

TR Capital is pleased to announce the official opening of its third office in Asia, in Mumbai

TR Capital performs fund restructuring into Asia Consumer Holdings LP

TR Capital is pleased to announce a new fund restructuring via a secondary investment into Asia Consumer Holdings LP (“ACH”). This represents the ninth investment of TR Capital III. In the context of a fund restructuring of Cassia Investments Limited Partnership II (“Cassia Fund II”), TR Capital has incorporated ACH to acquire stakes into 2 companies owned by Cassia Fund II: EVISU and Guilin Seamild.

EVISU is a retail brand specializing in premium jeans and denim-related products. The brand is inspired by vintage American denim and is widely recognized by its iconic branding, unique designs and premium quality. With an average retail price of USD 250, EVISU is predominantly focused on its designer denim products but has also expanded its product line to include leisure/sportswear products, with a strong focus towards its male customer base.

Guilin Seamild is a leading

manufacturer and distributor of premium oatmeal products in China. Seen as a

healthy food, the main target audience for Seamild is the middle-aged

population (40+ years old) with strong health consciousness. Seamild prides

itself on quality oats that it sources directly from contract farmers in

Western Australia. Current product categories include pure oatmeal, compound

oatmeal and ready-to-eat (RTE) oatmeal. All its products are marketed under the

“Western Oats” (“西麦”) brand.

2017

TR Capital wins the “Secondaries Firm of the Year in Asia” Award (2016) by Private Equity International

Successful exit of Secondary Direct investment in Vivimed Labs (UQUIFA)

TR Capital is pleased to announce the successful exit of its stakes into Vivimed Labs (UQUIFA).

TR Capital acquires a controlling stake in TIPEF1 (via a fund restructuring)

TR Capital invests in SSIPL Retail Ltd, India’s largest sports shoes retailer, via a Secondary Direct transaction by buying out a group of individual shareholders

TR Capital completes its 30th transaction with the secondary acquisition of an LP interest in a leading Vietnam fund (VIF II) from Bio-Invest

2016

TR Capital opens Shanghai office

TR Capital acquires a secondary stake in Source Photonics, a leading Chinese manufacturer of optoelectronic data communication modules, from Francisco Partners

Acquisition (via a Fund Restructuring) of a portfolio of 6 Indian companies (including Sedemac) from IIF

2015

TR Capital acquires a stake in Urban Ladder, India's leading online furniture company

Acquisition of a Secondary LP interest in a Chinese PE fund from Bank of Tokyo Mitsubishi

Launch of TR Capital III (Fund 3)

Acquisition of a Secondary LP interest in a Chinese fund from The Baupost Group

TR Capital has completed a new secondary fund investment to acquire an interest in Milestone China Opportunities Fund II, L.P. from an American hedge fund. The portfolio is composed of 5 companies in China which were invested between 2007 and 2011.

TR Capital exits Viva via a secondary sale to a Chinese fund

TR Capital is nominated "Secondaries Firm of the Year" by Private Equity International

2014

TR Capital exits HIG (Harvey Industries Group) via a successful tradesale to Minderoo Group in Australia

Acquisition of 2 Secondary LP interests in Innovation Works I from Google and Best Buy

TR Capital II has completed a new

secondary investment in Innovation Works

Development Fund, L.P. (“IW I” or the “Fund”) from 2 American corporations.

IW I is led by Dr. Kaifu Lee, the former

Greater China President of Google and founder of Microsoft Research Asia. IW I

is a leading TMT venture capital fund in China. The portfolio comprises 28 TMT companies in China with

cost-weighted-age of 2.0 years.

Secondary Direct in Flipkart, India's largest e-commerce company: TR closes its 20th investment in Asia

Acquisition of a Secondary LP interest in a leading Indian fund

TR Capital II has completed a secondary investment to acquire a Secondary LP interest in IDG Ventures India LLC.

TR Capital leads the exit of Sinomed via a successful secondary sale to Advantech

TR Capital acquires a stake in Lenskart, leading B2C eyewear e-commerce company in India

TR Capital is pleased to announce that it has closed a new secondary direct investment in Valyoo Technologies Private Limited (“Lenskart” or the “Company”) through TR Capital II (“Fund II”).

Lenskart is the

leading B2C eye-wears e-Commerce portal in India, selling prescription

eyeglasses, sunglasses and contact lenses to consumers in India. Created in 2010, the company has been growing at a rapid pace since then.

2013

TR Capital acquires a stake in Viva, the largest Chinese mobile magazine company based in Beijing

TR Capital successfully leads the exit of Qingdao Wuxiao Group via a secondary sale

Acquisition of a Secondary LP interest in a leading Indian VC fund

TR Capital II has completed a secondary investment to acquire a Secondary LP interest in IDG Ventures India LLC.

2012

Frederic Azemard (former CEO of Sunnco, Cognetas, Bain) joins the team as a Managing Partner

Launch of TR Capital II (Fund 2)

Successful exit of Harmony Capital (acquired in 2009) via a GP restructuring to PAG (Pacific Alliance Group)

Acquisition of a Secondary LP interest in New Horizon II from Deutsche Bank in Hong Kong

TR Capital II L.P. has completed a secondary investment to acquire an interest in New Horizon Capital, L.P. (“New Horizon II” or “NH2”). NH2 is a well-known fund for TR Capital Group, as TR Capital I already made a successful secondary acquisition in NH2 in July 2010. This fund is a USD 506 million growth capital private equity fund focusing on China.

Acquisition of a Secondary LP interest in a leading China VC fund from a European bank

TR Capital II L.P. has completed an early secondary investment

in Ventech China II SICAR (“Ventech II”).